Hard-to-Find Components in Industrial Electronics: What OEMs Need to Know

Managing hard-to-find components represents one of the most challenging aspects of electronics manufacturing for various industries. Original Equipment Manufacturers (OEMs) face increasing pressure to maintain production schedules while navigating component shortages, obsolescence cycles, and supply chain disruptions. Understanding how to effectively source and manage these critical components can mean the difference between meeting customer demands and experiencing costly production delays.

Key Takeaways

- Supply chain diversification reduces dependency on single sources for hard to find components

- Proactive obsolescence management helps prevent last-minute scrambling for replacements

- Authorized distributor partnerships ensure component authenticity and reliability

- Inventory forecasting balances carrying costs with availability for critical components

- Alternative sourcing strategies provide backup options when primary suppliers fall short

- Documentation and traceability maintain quality standards throughout the component lifecycle

Understanding the Challenge of Hard-to-Find Components

The industrial electronics landscape keeps getting more complex as manufacturers deal with shorter product lifecycles and rapidly changing technology requirements. Hard-to-find components often emerge from several scenarios that OEMs need to navigate carefully.

Component obsolescence happens when manufacturers stop production due to technology advances, low demand, or material availability issues. This natural progression leaves OEMs searching for suitable replacements or seeking remaining inventory from authorized sources. The challenge gets tougher when these components serve critical functions in established product lines with long operational lifespans.

Market demand changes create another layer of complexity in component availability. When multiple industries simultaneously need the same components, supply shortages develop quickly. Industrial electronics EMS providers often compete with automotive, aerospace, and consumer electronics manufacturers for limited component inventory, driving up costs and extending lead times.

Common categories of difficult-to-source components include:

- Legacy semiconductors - Older generation chips still required for existing product support

- Specialized connectors - Custom or low-volume connector solutions for specific applications

- Military-grade components - High-reliability parts with stringent qualification requirements

- Custom integrated circuits - Application-specific chips with limited production runs

- Electromechanical components - Switches, relays, and mechanical parts with unique specifications

Geographic supply chain disruptions have highlighted how vulnerable single-source component strategies can be. Natural disasters, political tensions, and pandemic-related shutdowns can instantly transform readily available components into scarce commodities requiring immediate attention from procurement teams.

Strategic Sourcing Approaches for Obsolete Electronic Components

Developing a solid sourcing strategy requires understanding various supply channels and their respective advantages. Each channel serves different needs based on component urgency, quantity requirements, and quality standards.

Authorized distributors provide the highest level of component authenticity and manufacturer support. These partnerships offer access to genuine components with full traceability documentation, warranty coverage, and technical support. While authorized channels may cost more, they deliver the reliability that's essential for critical applications and long-term product support.

Independent distributors fill gaps when authorized sources lack inventory or cannot meet delivery requirements. These suppliers often maintain extensive networks and specialized knowledge of particular component categories. However, OEMs need to implement solid incoming inspection procedures to verify component authenticity and quality when working with independent sources.

Broker networks and component exchanges offer additional sourcing opportunities through:

- Surplus inventory liquidation - Access to overstock from other manufacturers

- End-of-life component stockpiles - Strategic purchases from component manufacturers

- Global supplier networks - International sources for region-specific components

- Auction platforms - Competitive bidding for rare or discontinued components

Franchise distributors often provide hybrid solutions, combining authorized relationships with flexible inventory management. These partnerships can help OEMs access both current production components and legacy inventory through established distribution channels.

Contract manufacturers sometimes offer component sourcing as part of their service portfolio, using their purchasing power and supplier relationships to your advantage. This approach can be particularly helpful for OEMs with limited procurement resources or those entering new market segments.

Managing Component Obsolescence Proactively

Good obsolescence management requires systematic monitoring and planning to prevent supply disruptions. Smart OEMs put in place comprehensive tracking systems that monitor component lifecycle status and provide early warning of potential issues.

Product Change Notifications (PCNs) and End-of-Life (EOL) announcements provide critical timing information for obsolescence planning. Manufacturers typically issue these notifications months or years before discontinuation, creating opportunities for strategic inventory purchases or design modifications. Establishing direct communication channels with component suppliers ensures the timely receipt of these important updates.

Lifecycle forecasting helps predict component availability based on market trends, technology evolution, and manufacturer roadmaps. This analysis helps OEMs make informed decisions about long-term component strategies and identify potential replacements before shortages develop.

Proactive obsolescence management strategies include:

- Last-time-buy calculations - Determining optimal inventory quantities for EOL components

- Redesign planning - Scheduling product updates to incorporate available components

- Form-fit-function analysis - Identifying suitable replacement components in advance

- Supplier relationship management - Maintaining communication channels for lifecycle updates

Buffer stock management balances inventory carrying costs with supply security for critical components. OEMs need to evaluate the financial impact of extended inventory holding periods against the risks of production disruptions and customer delivery failures.

Design for availability incorporates component lifecycle considerations into new product development. Engineering teams can prioritize widely available components and establish multiple approved sources during the design phase, reducing future obsolescence challenges.

Building Resilient Supply Chain Partnerships

Strong supplier relationships form the foundation of successful hard-to-find component sourcing. OEMs benefit from building partnerships with multiple supplier types to create redundancy and flexibility in their procurement strategies.

Preferred supplier programs establish mutually beneficial relationships that provide priority access to limited inventory and advance notice of market changes. These partnerships often include volume commitments in exchange for preferential treatment during shortage situations.

Geographic diversification reduces supply chain vulnerability by distributing sourcing across multiple regions and suppliers. This approach helps reduce risks from localized disruptions while providing access to region-specific component sources and market knowledge.

| Supplier Type | Primary Benefits | Key Considerations |

|---|---|---|

| Authorized Distributors | Guaranteed authenticity, full support | Higher costs, limited flexibility |

| Independent Distributors | Competitive pricing, broad inventory | Quality verification required |

| Franchise Partners | Balanced approach, established relationships | Variable inventory access |

| Contract Manufacturers | Integrated sourcing, purchasing leverage | Dependency on third-party decisions |

Regular supplier performance evaluation ensures partnerships continue to meet evolving business requirements:

- Delivery performance - Tracking on-time delivery rates and lead time accuracy

- Quality metrics - Monitoring incoming inspection results and field failure rates

- Communication effectiveness - Evaluating responsiveness and information sharing

- Innovation support - Assessing contributions to new product development

Supplier development programs help partners improve their capabilities and better serve OEM requirements. These initiatives might include training programs, process improvements, or technology investments that benefit both parties.

Emergency sourcing protocols establish procedures for critical component shortages that threaten production schedules. These plans identify alternative suppliers, approve emergency purchasing procedures, and define quality verification processes for urgent procurement situations.

Quality Assurance and Risk Management

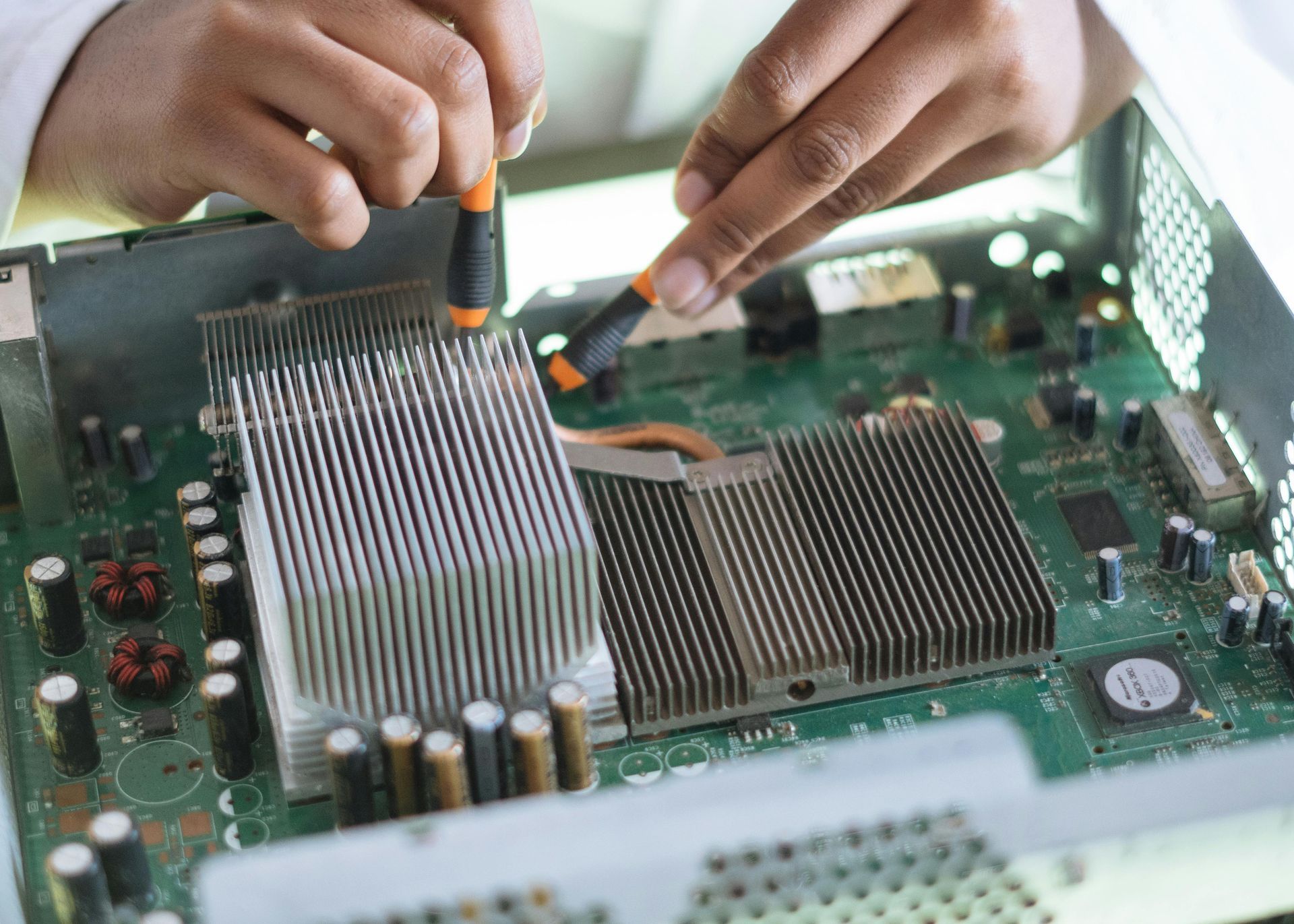

Maintaining component quality standards becomes increasingly challenging when sourcing hard-to-find components through non-traditional channels. OEMs need to put in place comprehensive verification procedures to ensure component integrity and reliability.

Incoming inspection protocols should address the specific risks associated with each sourcing channel. Components from independent distributors require more extensive testing than those from authorized sources, while surplus inventory may need additional verification of storage conditions and age-related degradation.

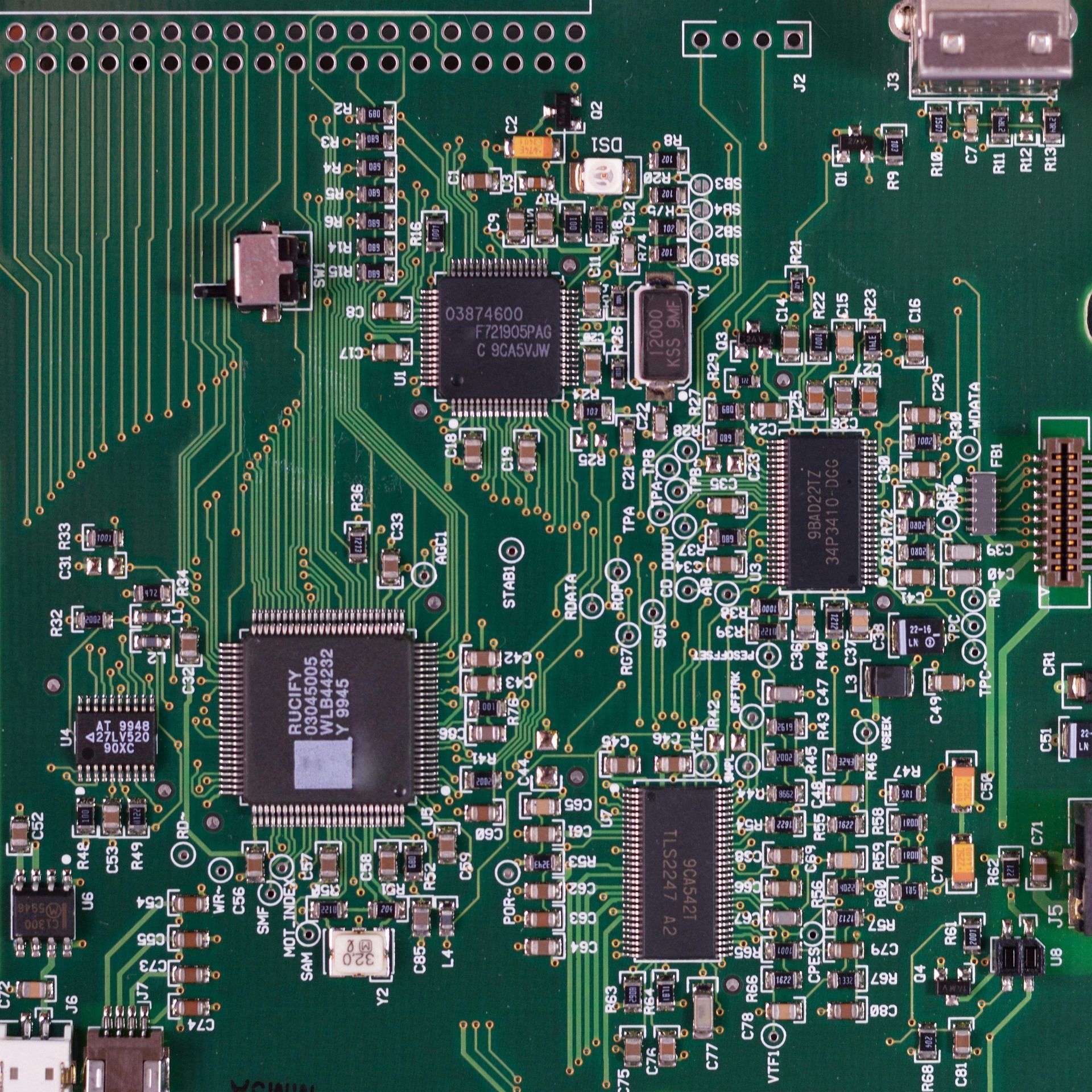

Critical quality verification procedures include:

- Visual inspection - Checking for physical damage, remarking, or counterfeit indicators

- Electrical testing - Verifying component specifications and performance parameters

- Package authentication - Confirming original manufacturer packaging and labeling

- Traceability documentation - Validating component origin and handling history

- Environmental stress testing - Assessing component reliability under operating conditions

Counterfeit component detection requires specialized knowledge and equipment to identify sophisticated forgeries. Training procurement and quality teams to recognize common counterfeit indicators helps prevent compromised components from entering production systems.

Risk assessment procedures evaluate potential impacts of component quality issues on final product performance and customer satisfaction. This analysis helps prioritize quality verification efforts and determine appropriate testing levels for different component categories.

Supplier qualification processes establish minimum standards for component sources and verify their ability to meet quality requirements. Regular audits ensure continued compliance and identify opportunities for improvement in supplier quality systems.

Technology Solutions for Component Management

Technology solutions streamline hard-to-find component management and improve decision-making through better data visibility and analysis capabilities.

Component lifecycle management systems connect with manufacturer databases to provide real-time obsolescence monitoring and automated alert generation. These platforms help procurement teams stay ahead of component discontinuations and plan appropriate responses.

Modern component management platforms typically offer:

- Real-time inventory tracking - Monitoring component availability across multiple suppliers

- Automated sourcing - Comparing prices and delivery options from various sources

- Obsolescence forecasting - Predicting future availability based on lifecycle data

- Quality management - Tracking inspection results and supplier performance

- Cost optimization - Analyzing total cost of ownership across sourcing options

Predictive analytics enhances forecasting accuracy by analyzing historical patterns, market trends, and supplier behavior. These tools help predict future component shortages and recommend better inventory strategies.

Supply chain visibility platforms provide end-to-end tracking of component movement from manufacturer to final assembly. This transparency helps identify potential disruptions early and allows for proactive response planning.

Integration with enterprise resource planning (ERP) systems ensures component management aligns with broader business operations and financial planning. Smooth data flow between systems improves coordination and reduces manual data entry errors.

Frequently Asked Questions

What makes industrial electronic components hard to find?

Components become difficult to source due to manufacturer discontinuation, market demand spikes, supply chain disruptions, or transition to newer technologies. Geographic concentration of manufacturing also creates vulnerability when regional issues affect production.

How can OEMs prepare for component obsolescence?

Monitor Product Change Notifications and End-of-Life announcements from manufacturers while maintaining relationships with multiple suppliers. Put in place lifecycle tracking systems and plan last-time-buy quantities based on future production forecasts.

What are the risks of using independent component distributors?

Independent sources may carry counterfeit, remarked, or improperly stored components that could compromise product reliability. Thorough incoming inspection and supplier qualification help reduce these risks while accessing broader inventory options.

How long should companies hold buffer stock for critical components?

Buffer stock duration depends on component lead times, obsolescence risk, carrying costs, and production requirements. Generally, maintaining 6-12 months of safety stock for critical hard-to-find components balances availability with inventory costs.

What role do contract manufacturers play in component sourcing?

Contract manufacturers often use their purchasing volume and supplier relationships to access hard-to-find components more effectively than individual OEMs. They may also provide component sourcing as a value-added service to their manufacturing offerings.

Final Thoughts

Successfully managing hard-to-find components requires a comprehensive strategy that combines proactive planning, diversified sourcing, strong supplier relationships, and solid quality systems. OEMs that invest in these capabilities position themselves to navigate supply challenges effectively while maintaining production continuity and customer satisfaction. The complexity of modern supply chains demands thoughtful approaches, but the rewards of reliable component availability justify the investment in comprehensive sourcing strategies.

Don't let hard-to-find components disrupt your production schedules. Partner with our experienced sourcing specialists who understand the complexities of industrial electronics procurement and can help you build a resilient supply chain strategy for long-term success.

Reference:

https://www.z2data.com/insights/3-key-things-to-know-about-product-change-notifications