Hard-to-Find Electronic Parts: Navigating Challenges in Automotive Manufacturing

The automotive electronics industry faces significant challenges when sourcing critical components, with hard-to-find electronic parts creating bottlenecks in manufacturing operations. As vehicles incorporate more electronic control units, advanced safety systems, and electrification technologies, manufacturers must manage complex supply chains while addressing component obsolescence, allocation constraints, and extended lead times that can disrupt production schedules.

Key Takeaways

- Supply chain complexity has increased automotive electronics EMS challenges, requiring proactive sourcing strategies and alternative component identification processes

- Obsolete electronic components frequently lack direct replacements, creating the need for redesign efforts or partnerships with specialized sourcing providers

- Automotive supply chain resilience relies on diversified supplier networks and strategic inventory management for critical hard-to-find components

- Electronic component sourcing requires market knowledge and relationships with authorized distributors, brokers, and excess inventory suppliers

- Planning and monitoring help manufacturers anticipate component shortages before they impact production schedules and delivery commitments

- Quality verification becomes essential when sourcing hard-to-find electronic parts from non-traditional suppliers to maintain automotive reliability standards

Understanding the Automotive Electronics Supply Chain

The automotive industry's shift from mechanical systems to electronically controlled solutions has created a high demand for specialized components. Modern vehicles follow a seven-year lifecycle, with manufacturing running at full scale for the first few years, yet electronic components often have shorter availability periods than vehicle production runs.

Automotive electronics providers face distinct challenges due to quality requirements, product lifecycles, and environmental demands. When manufacturers encounter hard-to-find electronic parts, the consequences extend beyond production delays to affect warranty obligations and customer relationships.

Vehicle platforms introduced during the 1980s lasted 8.6 years before new platform introduction or retirement, while platforms from the 1990s and 2000s averaged 7.6 years. This creates mismatches between vehicle service needs and component availability, forcing manufacturers to seek alternatives through specialized sourcing channels.

Common Categories of Hard-to-Find Components

The following component types frequently become difficult to source as vehicles age and technology evolves:

Legacy Processing Units

Older automotive systems depend on specific microcontrollers that manufacturers discontinue as they focus on newer architectures. These processors often contain custom firmware that cannot transfer easily to replacement components without software modifications. Sourcing decisions must balance cost factors against the technical feasibility of system updates.

Application-Specific Sensors

Automotive applications require sensors meeting precise performance criteria for:

- Temperature range specifications (-40 °C to +125 °C typically)

- Vibration resistance standards

- Electromagnetic compatibility requirements

- Moisture and corrosion protection

Custom or low-volume sensors become particularly challenging when original suppliers exit the automotive market or discontinue specific product lines.

Power Regulation Components

Electronic systems require precise power management across extreme temperature ranges. Hard-to-find components include:

- Specialized voltage regulators for automotive specifications

- Power modules designed for vehicle electrical systems

- Protection circuits meeting automotive safety standards

- DC-DC converters for specific voltage requirements

Interface Components

Communication protocol evolution creates obsolescence for older interface components. New standards may lack backward compatibility, requiring manufacturers to support multiple vehicle generations with different communication architectures.

Strategic Component Sourcing Approaches

Proactive Lifecycle Management

Successful automotive electronics EMS operations track component availability to identify potential shortages before production impact. This process involves:

- Monitoring manufacturer notifications: Companies track product change notifications (PCNs) and end-of-life announcements to identify at-risk components early in the planning cycle.

- Establishing supplier relationships: Partnerships with component suppliers provide advance notice of discontinuations and alternative recommendations, enabling engineering teams to evaluate options while original components remain available.

- Implementing tracking systems: Digital platforms monitor component lifecycle status and market availability trends to develop mitigation strategies before shortages occur.

Diversified Sourcing Networks

Single-source components create vulnerability when parts become unavailable through traditional channels. Manufacturers work with electronic component sourcing specialists, maintaining relationships across multiple supplier tiers.

Common sourcing channels include:

| Sourcing Channel | Applications | Lead Times | Quality Standards |

|---|---|---|---|

| Authorized Distributors | New production, standard parts | 2-16 weeks | Full manufacturer warranty |

| Franchise Distributors | Volume orders, allocated components | 4-20 weeks | Manufacturer-backed quality |

| Independent Distributors | Hard-to-find parts, excess inventory | 1-12 weeks | Verification procedures required |

| Component Brokers | Obsolete components, emergency sourcing | 1-8 weeks | Extensive testing protocols |

| Surplus Suppliers | Discontinued parts, cost optimization | 2-10 weeks | Quality assessment essential |

Alternative Component Evaluation

When exact replacements are unavailable, engineering teams evaluate alternatives that meet functional requirements while maintaining system performance. This process requires:

- Technical compatibility analysis: Engineers verify that replacement components match electrical specifications, physical packaging, and interface requirements for existing circuit designs

- Performance validation: Testing protocols confirm that alternative components maintain system functionality across temperature ranges, electromagnetic environments, and operational conditions.

- Quality assessment: Collaboration between design engineers, sourcing specialists, and quality teams validates that replacement parts meet automotive reliability standards through environmental testing and long-term reliability evaluation.

Quality Assurance for Non-Traditional Sources

Sourcing hard-to-find electronic parts often requires purchasing from suppliers outside traditional automotive channels, creating quality risks requiring careful management. Automotive applications demand components meeting strict reliability standards.

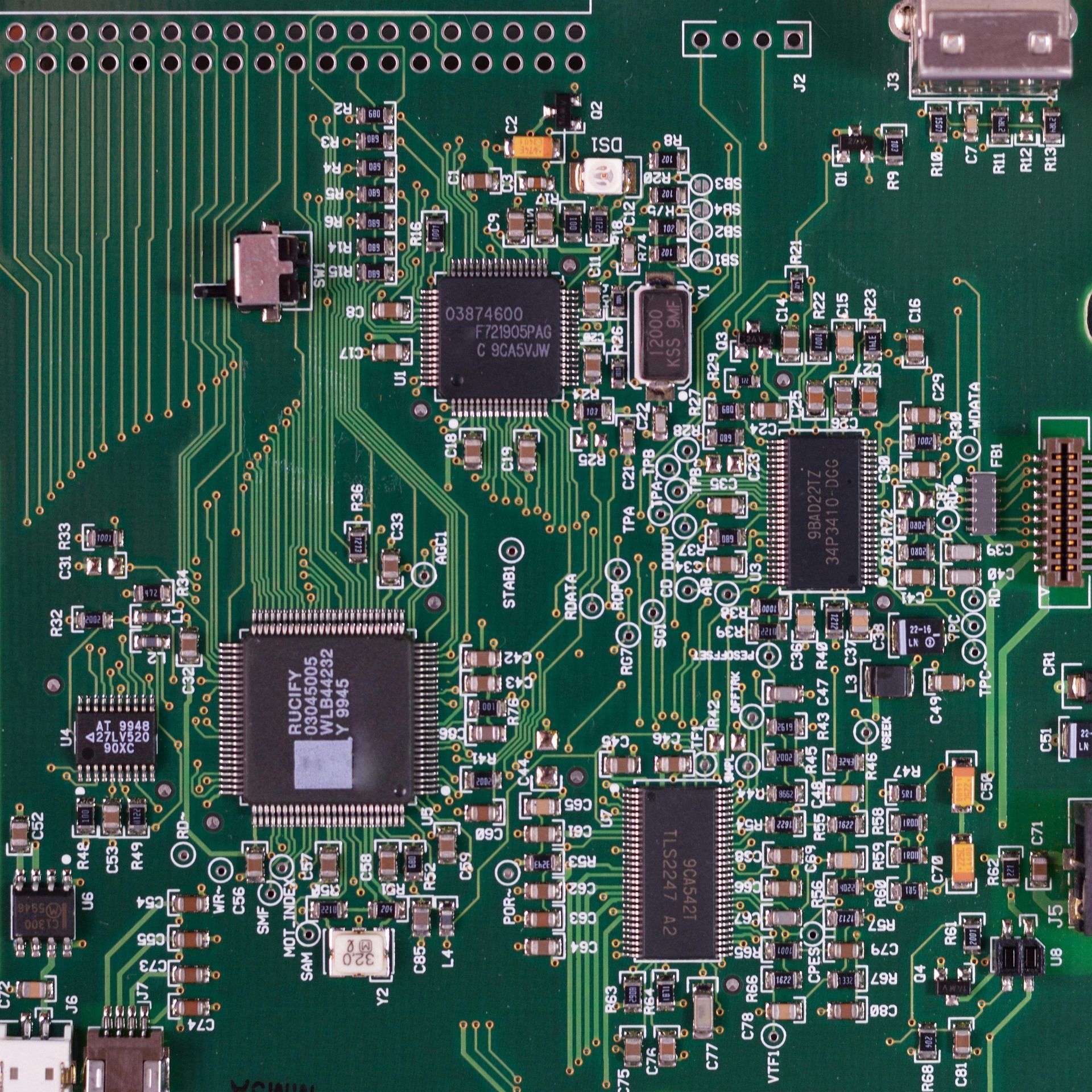

Component Authentication Procedures

Independent testing becomes necessary when sourcing obsolete electronic components from non-traditional suppliers. Manufacturers implement inspection procedures that verify:

- Component authenticity: Visual inspection for remarking, tampering, or counterfeit indicators ensures components originate from legitimate manufacturing sources.

- Electrical performance: Testing confirms that components meet specification requirements for voltage, current, frequency response, and other critical parameters.

- Environmental compliance: Verification procedures ensure components meet automotive environmental standards for temperature cycling, moisture resistance, and electromagnetic compatibility.

- Traceability documentation: Records establish component origin and handling history to support quality requirements and failure analysis procedures.

Documentation Requirements

Automotive supply chain requirements mandate comprehensive documentation for emission control components, with manufacturers liable for warranty coverage for 8 years or 80,000 miles for major components. When sourcing hard-to-find electronic parts through non-traditional channels, manufacturers must establish traceability meeting automotive quality standards.

Documentation requirements include:

- Original manufacturing source verification

- Storage condition records

- Handling procedure documentation

- Quality test results

- Chain of custody information

Specialized sourcing providers maintain detailed records supporting these requirements for warranty claims and field failure analysis.

Managing Obsolete Electronic Components

Component obsolescence challenges automotive electronics manufacturing, particularly for manufacturers supporting multiple product generations or providing long-term service availability. Most new car warranties cover major parts for several years, with powertrain warranties often extending to 10 years or 100,000 miles, creating extended support obligations.

Last-Time Buy Planning

End-of-life notifications for critical components require analysis of future demand, storage costs, and alternative development timelines. Decisions must balance inventory investment against future sourcing risks.

Demand forecasting: Collaboration between engineering, purchasing, and planning teams develops accurate projections accounting for:

- Production volume requirements

- Service parts demand estimates

- Potential design applications for other products

- Market demand variability factors

Storage considerations: Component purchases must account for:

- Moisture sensitivity and environmental degradation

- Warehouse capacity and handling costs

- Insurance and inventory carrying expenses

- Component shelf life limitations

Industry coordination: Some manufacturers coordinate with partners to share large minimum order quantities for commonly used components, reducing individual inventory risks while ensuring availability.

Redesign vs. Sourcing Analysis

When obsolete electronic components become unavailable through traditional channels, manufacturers evaluate redesign options against continued sourcing through alternative suppliers.

Redesign evaluation factors:

- Engineering resource requirements

- Validation testing scope and timeline

- Regulatory approval processes

- Manufacturing process changes

- Long-term component availability

Alternative sourcing considerations:

- Component authenticity and quality risks

- Pricing volatility and availability uncertainty

- Supplier qualification requirements

- Testing and validation procedures

Successful redesigns eliminate future sourcing risks and may provide cost reduction or performance improvement opportunities, but require significant engineering investment and validation effort.

Technology Tools for Component Sourcing

Modern automotive electronics EMS operations use digital platforms to manage sourcing challenges and identify hard-to-find electronic parts across global supplier networks.

Supply Chain Visibility Systems

Advanced management systems provide real-time visibility into component inventory across multiple supplier tiers, enabling manufacturers to identify potential shortages before production impact.

- Integration capabilities: Platforms connect with supplier systems to provide automated alerts when component availability falls below predetermined thresholds.

- Market intelligence features: Tools track pricing trends, lead time changes, and availability patterns to support inventory planning and alternative component evaluation decisions.

- Risk assessment: Systems evaluate supplier performance history and component authenticity records to support sourcing decisions for hard-to-find electronic parts.

Automated Sourcing Platforms

Electronic component sourcing platforms connect manufacturers with global supplier networks, providing access to inventory not visible through traditional distribution channels.

- Network access: Platforms include specialized suppliers focusing on obsolete electronic components and hard-to-find parts unavailable through primary distribution.

- Query automation: Tools simultaneously search multiple suppliers for specific components, compare pricing and availability, and provide risk assessments based on supplier performance data.

- Response optimization: Automation reduces the time required to identify sourcing options and enables faster response to production requirements and emergency sourcing needs.

Frequently Asked Questions

How can manufacturers reduce dependency on hard-to-find electronic parts?

Implement proactive component lifecycle management and design products using components with longer availability windows. Establish supplier partnerships providing advanced discontinuation notice to enable better planning for alternative components.

What quality risks exist when sourcing obsolete electronic components from independent suppliers?

Independent suppliers may offer components with questionable authenticity, improper storage conditions, or unknown handling history. Comprehensive testing and authentication procedures are required to verify component quality and reliability.

How long should manufacturers plan for when sourcing hard-to-find components?

Lead times range from days to months, depending on component availability and sourcing channels. Planning for 12-26 weeks provides sufficient time to identify alternatives and complete necessary testing for critical applications.

What documentation is required when using non-traditional component sources in automotive applications?

Complete traceability documentation, including original manufacturing records, storage conditions, and handling procedures. Documentation must satisfy automotive quality standards and support warranty requirements for component failures.

How can automotive electronics EMS providers better manage component obsolescence risks?

Establish relationships with specialized sourcing partners and implement component monitoring systems tracking lifecycle status. Diversify supplier networks and maintain strategic inventory for critical components to reduce obsolescence impact.

Final Thoughts

Managing hard-to-find electronic parts in automotive manufacturing requires planning, diversified sourcing strategies, and quality management. As the automotive industry incorporates more complex electronic systems, manufacturers investing in component sourcing capabilities and supplier relationships will maintain production continuity and meet customer commitments despite supply chain challenges.

Need help sourcing hard-to-find electronic components for your automotive project? Contact the specialists at epsems.com for expert component sourcing solutions.

Reference:

https://en.wikipedia.org/wiki/Product_change_notification